- Solana Institutional

- Posts

- Solana Institutional - May 2024

Solana Institutional - May 2024

Institutional updates from Solana ecosystem

Headline of the Month

PayPal USD is now on Solana

PayPal has released their USD stablecoin on Solana blockchain!

Paypal has detailed the merits of Solana Token Extensions here. This is massive validation for Solana’s scalability and the chain can support mainstream payments use cases.

Consensus and Island DAO

Don’t miss Solana Hacker House in London - July 5-6th, 2024.

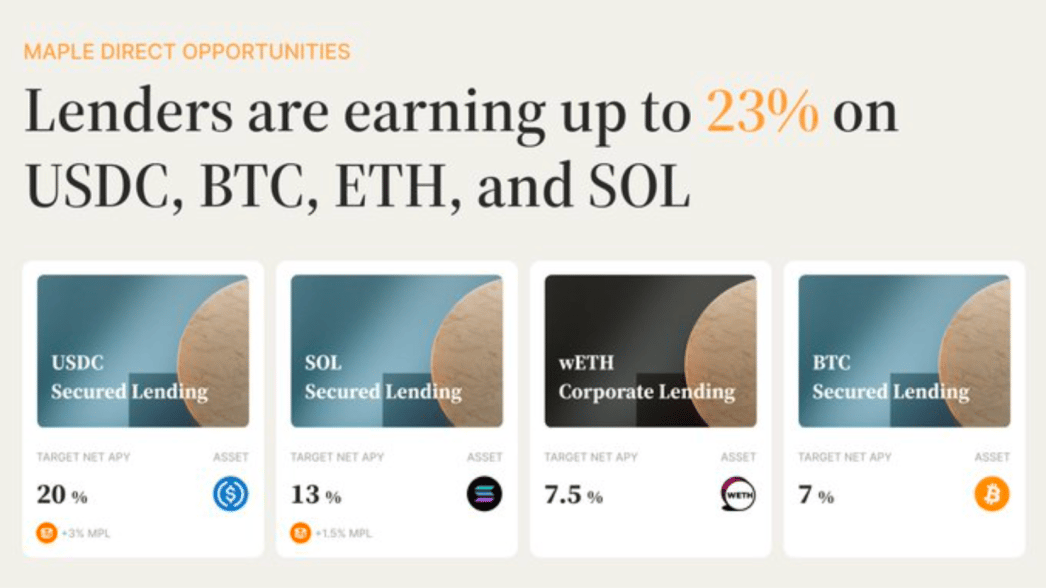

An institution-grade lending platform

Maple surpasses 200MM in TVL on the back of strong growth across both Secured Lending Pools

Our new Global Permissioning feature enables integrations with custodians and exchanges for compliant capital

High Yield Secured Pool has significantly outperformed Aave USDC lenders since launch

Institutions and Accredited Investors can now enjoy exclusive access to lending in digital assets with just one account.

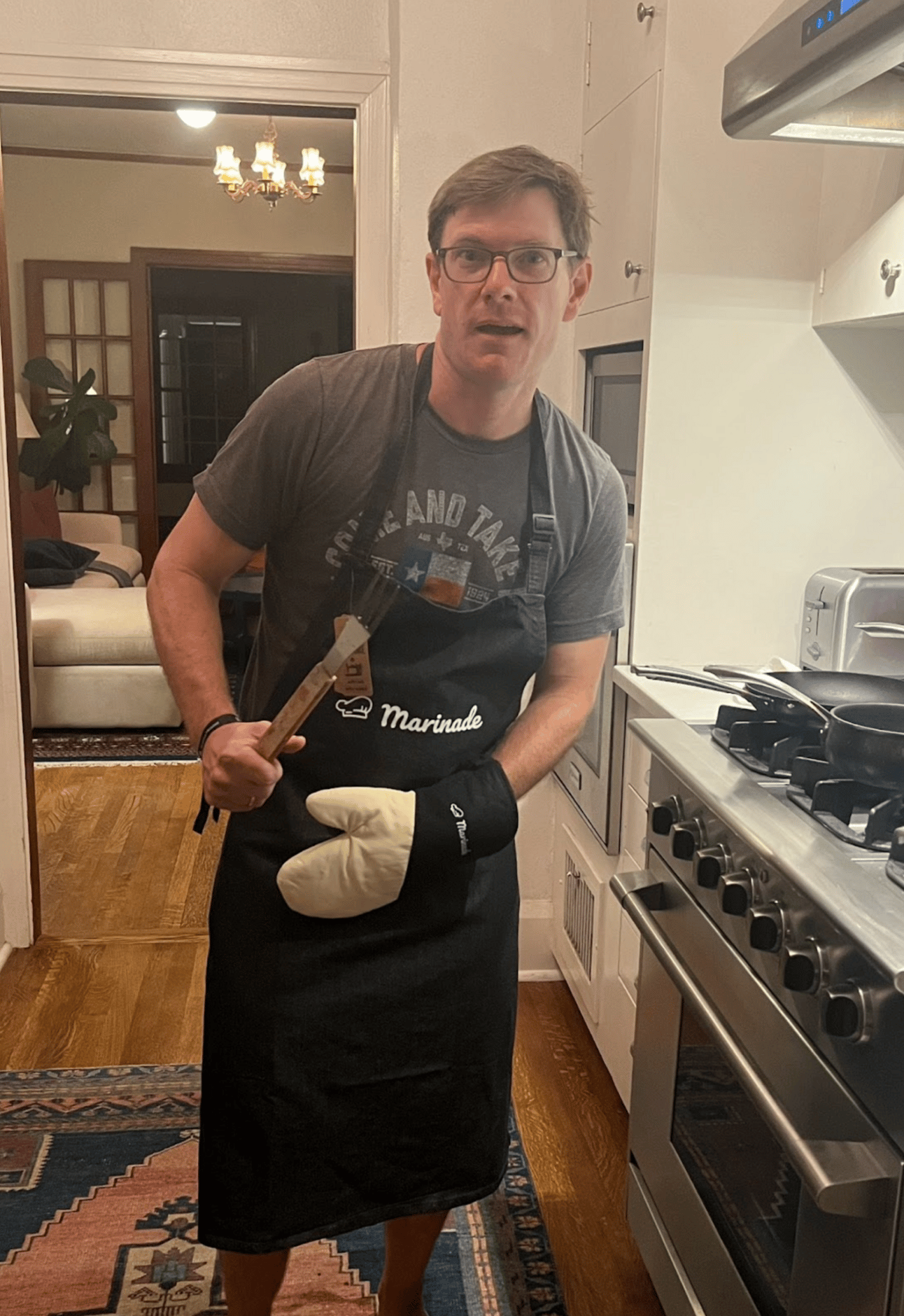

A staking solution provider on Solana with over 8M SOL TVL

Marinade’s Protected Staking Rewards (PSR) programme saw increased adoption with 500+ validators signing the bond. Over 99.9% of the Marinade’s TVL is now protected by our pool of validators.

Marinade’s new delegation strategy was approved by the DAO. The new delegation strategy sets us on the journey towards Marinade v2.0, with a view to increasing the staking rewards over the coming months.

Ecosystem Updates: Data

Smarter data for smarter contracts

Launch of the Pyth Ecosystem Grants Program. 50,000,000 Pyth allocated by the Pyth Data Association — to encourage communty members to share their ideas and insights about the Pyth Network with the wider Web3 community and contribute to its development through educational and research initiatives.

Pyth Data secures $4.4B, a 160% increase since the start of 2024

Pyth’s pull oracle facilitated over $110 billion in traded volume in April. That’s a 17x increase over the last year.

The Pyth DAO Forum was launched in May.

This forum will be the designated community discussion forum for ideas and formal proposals for shaping and expanding the network.

Ecosystem Updates: Tokenization

Institutional grade on-chain finance

Ondo Finance became the leading provider of tokenized US Treasuries, ahead of Blackrock and Franklin Templeton, with its OUSG and USDY offerings recently exceeding a combined TVL of $420M.

This accomplishment was supported by $54M in assets held on Solana, with TVL growth continuing since launching on the blockchain five months ago.

Ondo Finance launched instant, 24/7/365 minting and redeeming for OUSG with lower $10,000 investment minimums for instant transactions.

Ondo Finance launched new forms of OUSG and USDY – rOUSG and rUSDY – with a constant $1.00 per share mint/redeem price, with yield distributed each business day in the form of increased token balances via token rebasement.

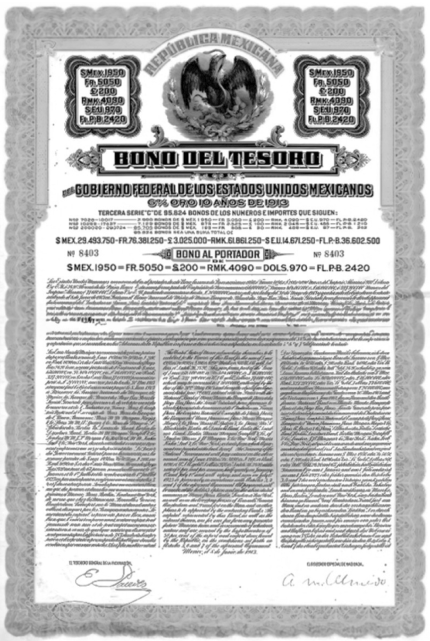

Institutional-grade blockchain bonds

Etherfuse partnered with @Brale_xyz to launch Real MXN (MXNe), a Mexican Peso bond-backed stablecoin on @Solana and @StellarOrg. MXNe will transform on-chain payments, remittances, and payroll in Mexico. Etherfuse also launched the first and only MXN stable on Solana.

Structured products on Solana

In May, Obligate saw a lot of groundbreaking transactions, ranging from non-bank lenders such as Invoitix (Factoring company), Mikro Kapital, one of Europe's leading micro lender, to corporates like BermudAir, a boutique airline, and one of Europe's largest digital asset brokers with $5bn AUM (refinancing their lombard-lending business) issuing peer-to-peer bonds 🚀🚀🚀🚀🚀

Some of these issuances were repeat transactions by existing Obligate customers, returning to Obligate for the customer experience which puts TradFi banking services in a corner. After all, Obligate’s markers for success are the fact that their customers, corporates and non-bank lenders from around the globe, use their services not for PR or pilot purposes but because it’s the better alternative to bank-based lines of credits, syndicated loans and private bonds 🏦🏦

Top Solana Blockchain News

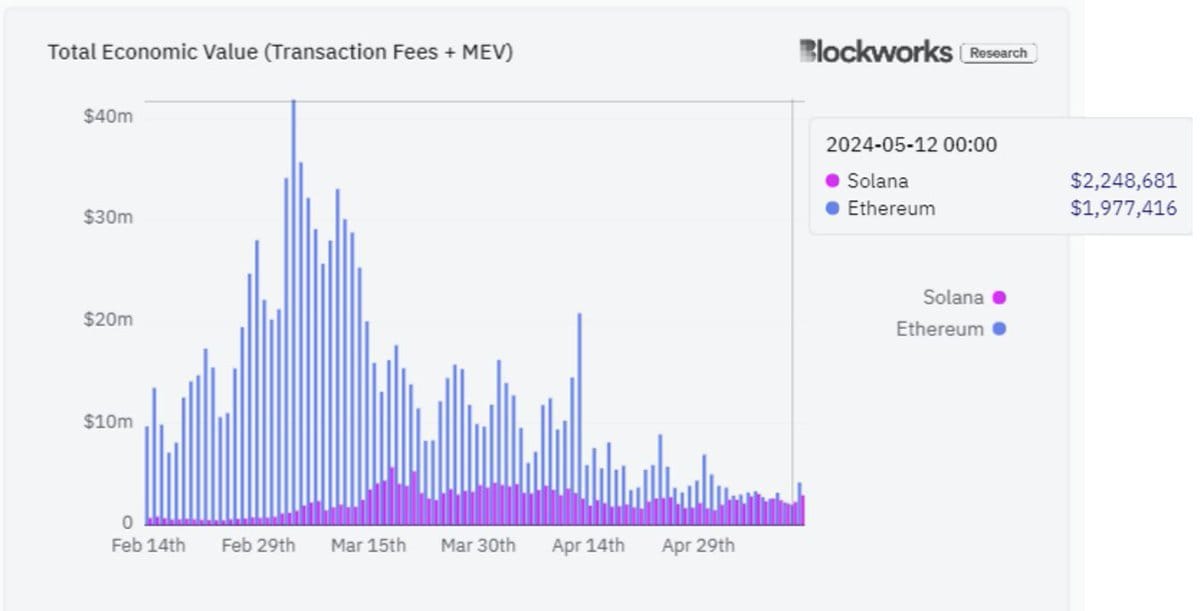

MEV Fees

On May 12th, for the first time, Solana generated more Transaction Fees and MEV than Ethereum in a single day. Solana doesn’t have mempools like Ethereum does, which makes it a bigger win for the chain.

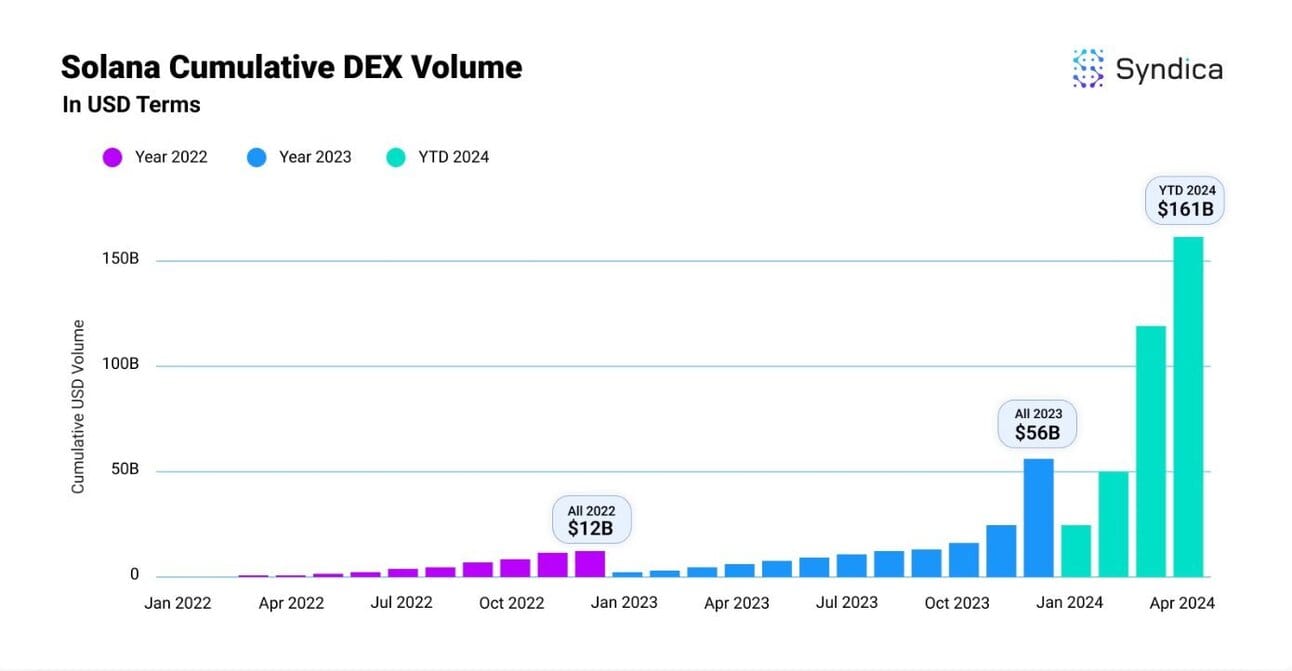

DeX Volumes

DeX volumes on Solana have been sky rocketing through 2024. The 2024 YTD stands at $161 Billion as of April 2024. May 2024 say $35 Billion in DeX volumes on the chain.

With milestones like the Paypal integration combined with surging activity, May couldn’t have been better for the chain