- Solana Institutional

- Posts

- Solana Institutional - July 2024

Solana Institutional - July 2024

Institutional updates from Solana ecosystem

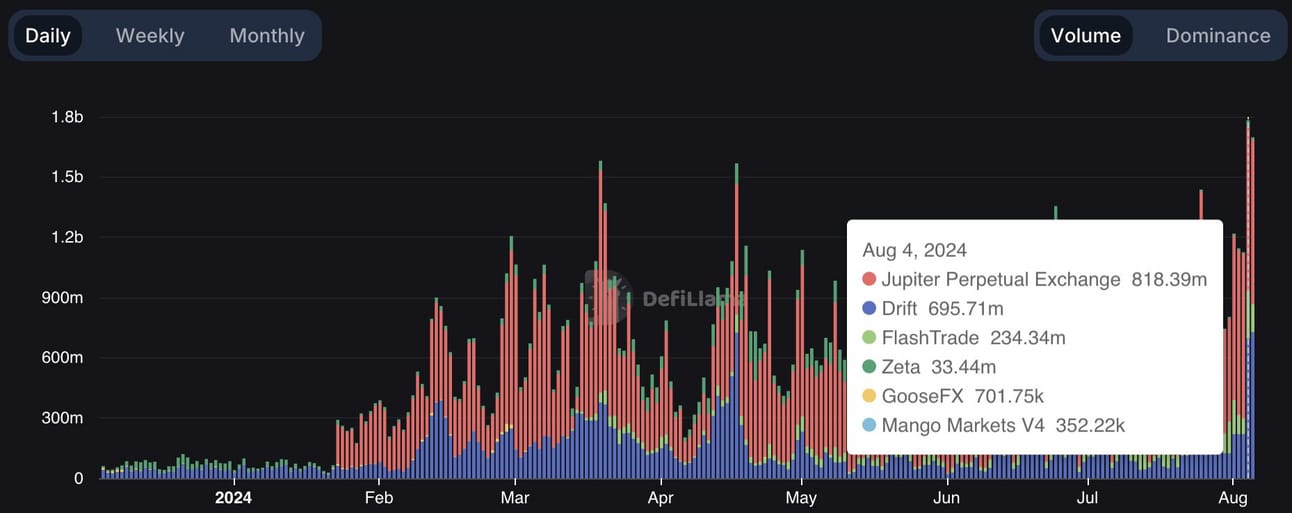

How Solana DeFi did on black Monday

Solana's perpetual DEX volume reached an all-time high of $1.78B on August 4th during the recent market crash.

Ecosystem Events

Two awesome ecosystem events happened this month. Solana Hacker House in London and Bengaluru, and Solana All stars in Nigeria and Venezuela. That was really impressive!

Ecosystem Updates: Tokenization

Agridex signed a range of new institutional clients.

Next steps are to get out some videos and human interest stories of people using the product.

AgriDex Settles Its First Agricultural Trades on Solana Blockchain

CoindeskSolana-Based Marketplace AgriDex Raises $5M to Tokenize Agricultural Industry

Coindesk

Etherfuse updates

Etherfuse secured $3 million in seed funding, co-led by White Star Capital and North Island Ventures. This investment supports Etherfuse's mission to enhance global capital markets through blockchain technology.

Purchase Order Feature: Etherfuse introduced Purchase Order feature last month, allowing users to secure bond purchases in advance, even during high demand periods, ensuring continuous access to their investment options.

Expansion Plans: Etherfuse plans to tokenize over 3,500 real-world assets within the next 18 months, including government short-term debt instruments and assets from the Mexican stock exchange.

Platform Enhancements: Etherfuse updated the platform to include monthly statements for wallets with rollover-style tokens and streamlined the KYC process, improving overall user experience.

Propy acquired and staked $PRCL to access the Parcl Labs API, which will be used to enhance valuation and analytics capabilities related to Propy's PropKey initiative.

News releaseThe Pittsburgh market was launched, the 19th market live on Parcl.

$PRCL staking is live and over 18M tokens have been staked thus far.

The Parcl Foundation is pleased to announce that it has begun decentralizing its governance. A test proposal is now active on Parcl DAO and all $PRCL stakers are eligible to vote.

Obligate updates

Tracker certificate on TradeFlow available, that tracks the performance of the USD Trade Flow Fund SP (ISIN: KYG1988M6375) and enables direct digital asset investments. Fund transactions are backed by liquid commodities and overcollateralized to reduce price volatility. On redemption date investors receive a cash settlement in USDC, calculated by multiplying the invested amount by the ratio of the final fixing level to the initial fixing level of the underlying.

AgroRefiner, a powerhouse in industrial hemp processing, is issuing a series of eNotes (corporate bonds) with Obligate to fuel its growth amid rising demand for hemp products in the US and globally. Investors will get a fixed yield of 11.50% p.a., while XBTO serves as bookrunner and placement agent for this transactions.

In addition we see growing demand in our AMC structures: especially TradFi clients like to diversify through pool investment into our underlyings and adding different yield, maturity and rating parameters to enhance their investment universe. Also available as model portfolios with different risk/return profiles (conservative, moderate & offensive) now.

More Headlines from the Solana Ecosystem

Global Adoption Highlights

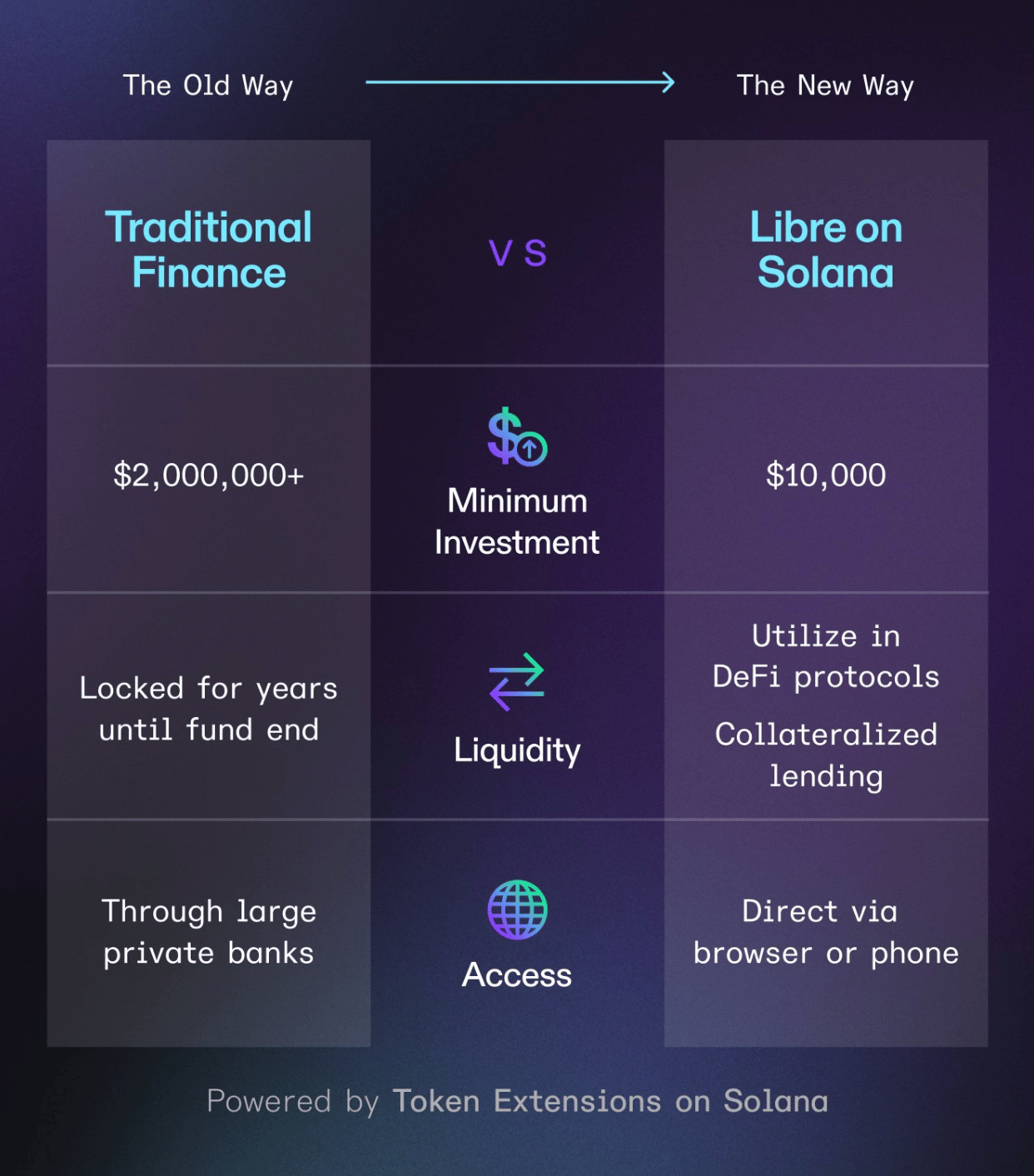

Libre announced the launch of two tokenized PE funds, allowing public investment in Brevan Howard Digital and Hamilton Lane portfolios

Through this integration, Tether USD (USDT) will be used as a reward mechanism for Jambo users across global markets such asd Africa, Southeast Asia, and Latin America. Transfers of USDT will be made via the Solana blockchain.

CBOE is one of the largest equity exchange operators in the world, and this filing highlights the confidence that US legacy financial institutions have in Solana and its native SOL token.

GCash is the most popular finance mobile app in the Philippines, with 86 million users as of 2023. This is a major example of Solana’s ability to integrate “web3” with “web2,” thereby fostering global adoption.

Project-Specific News

In addition to their reputable lending service, Save announced a new stablecoin called Save USD (SUSD), an LST named saveSOL, and dumpy.fun, which allows users to short memecoins.

This unprecedented marketplace allows users to monetize their subscriptions by selling unused hours, highlighting the flexibility of on-chain financial services.

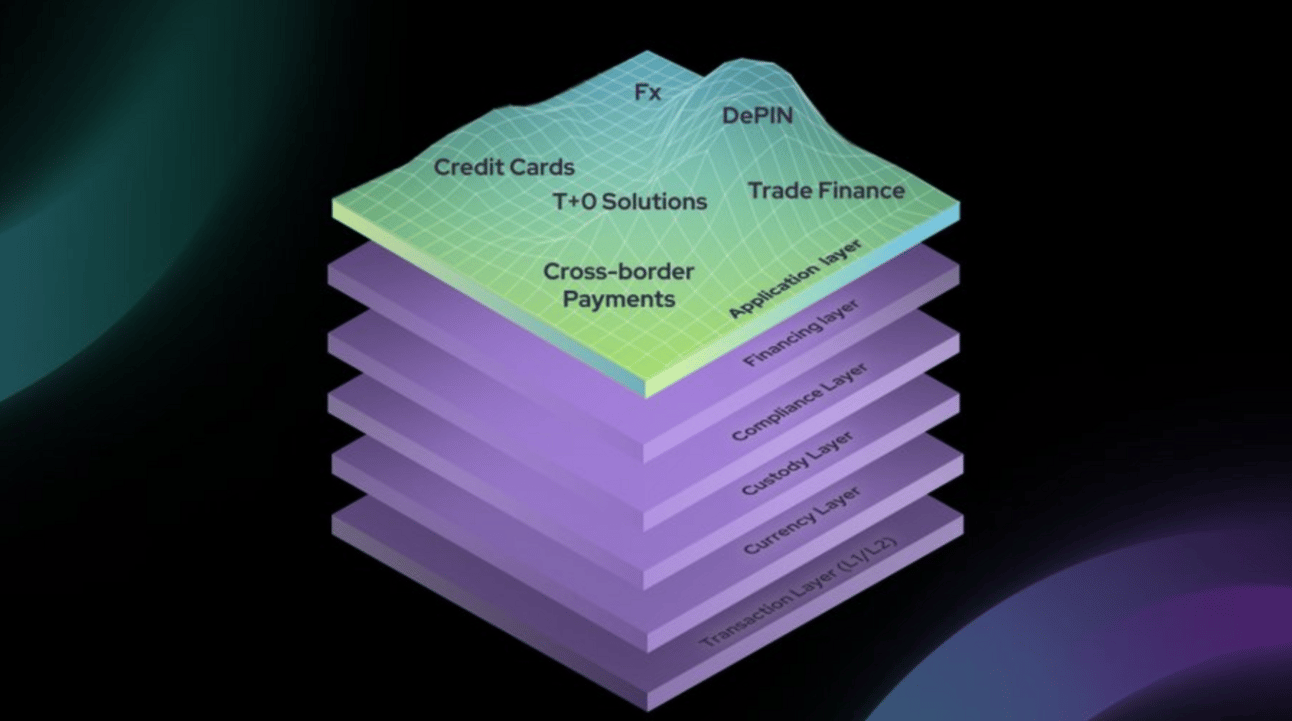

Huma Finance explains their vision to usher in the next wave of financing by leveraging the speed, liquidity, and tokenization of on-chain finance.

Drift, a top-10 platform on Solana in terms of TVL, announced their plans to launch a prediction market in mid-August, which will enable users to bet on the outcome of sporting events, elections, and much more.

While still in early stages of development, Jito’s restaking product aims to potentially allow any SPL token to be staked to secure any app in the Solana ecosystem.

On-Chain Activity

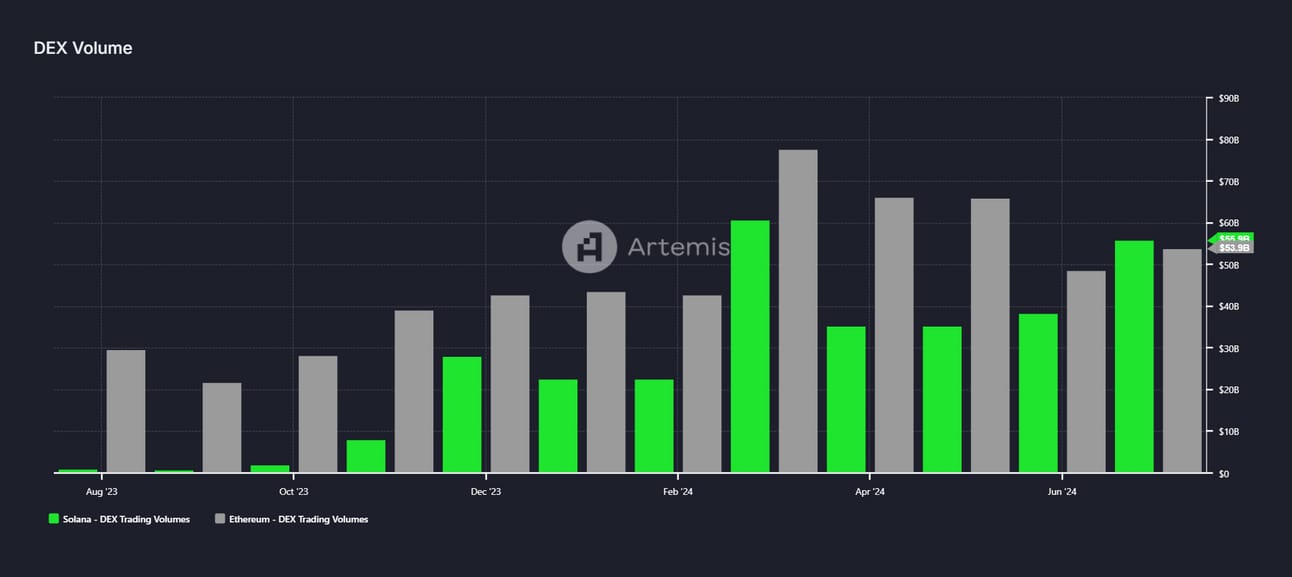

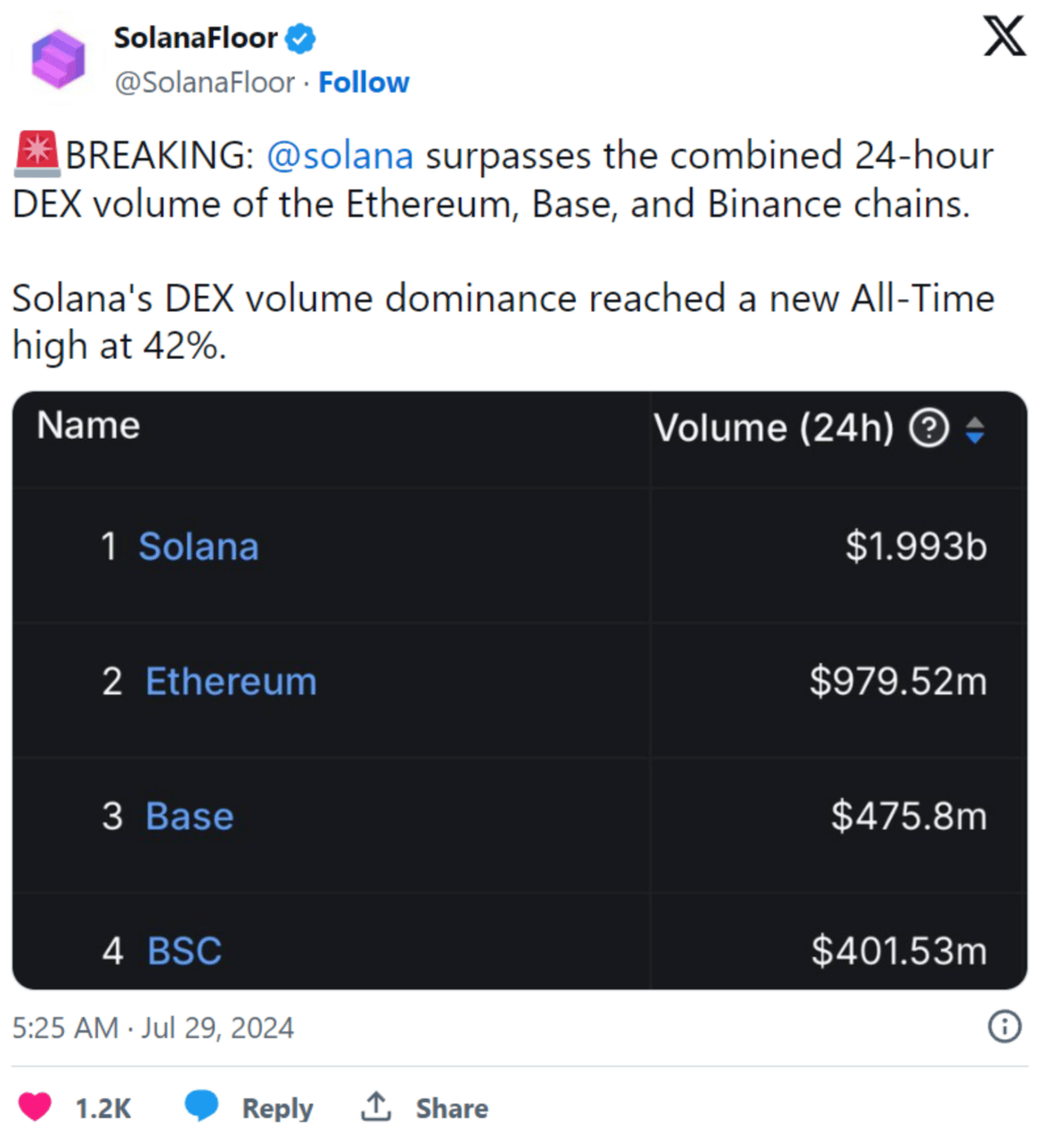

In addition to dominating 24-hour DEX volume, Solana reached another major milestone by seeing greater DEX volume than Ethereum for the entire month of July.

Both of these feats mark major milestones for Solana, as Ethereum has historically dominated the on-chain financial space.